(Reuters) -China’s state-backed funds are pulling back from investing in the funds of U.S.-headquartered private capital firms amid an escalating trade war between the world’s two biggest economies, the Financial Times reported on Monday.

Some of the Chinese funds are also seeking to be excluded from investments in U.S. companies made by private equity firms based elsewhere, the report, which cited seven private equity executives with knowledge of the matter, said.

Multiple buyout executives will not be making new fund commitments to U.S firms, while some are backing out of planned allocations, in cases where they had not yet made a final commitment, the report added.

Their stance comes at a time when U.S. President Donald Trump has singled out China in his trade war by imposing 145% tariffs on Chinese goods, with Beijing retaliating with 125% levies on American products.

Three of FT’s unnamed sources confirmed the move comes as response to the pressure of the Chinese government.

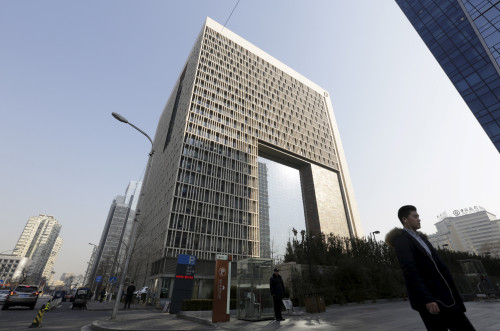

China Investment Corporation (CIC), which set up a private equity “partnership fund” with Goldman Sachs in Trump’s first term, is among the several Chinese funds that has stepped back, the report added.

Global Infrastructure Partners, which was bought by BlackRock last year, Thoma Bravo, Vista Equity Partners, Carlyle and Blackstone were among the U.S firms that have received backing from Chinese state-backed investors, the report said.

(Reporting by Sherin Sunny in Bengaluru; Editing by Leroy Leo)